Image may be NSFW.

Clik here to view. In the past few years there has been much disruption in the wealth management space especially with the influx of roboadvisors. Sliced Investing takes a different approach, offering registered investment advisors access to alternative investments.

In the past few years there has been much disruption in the wealth management space especially with the influx of roboadvisors. Sliced Investing takes a different approach, offering registered investment advisors access to alternative investments.

Facts

- Launched 2014

- $20+ million invested through the platform

- Headquartered in San Francisco

- 8 employees

At FinovateFall 2015 Sliced debuted its offering for institutional investors. Not only does Sliced enable investors to deploy strategies in minutes, it also offers access to hedge funds and private equity funds with $10,000 minimums. This enables advisors to diversify clients’ portfolios by adding alternative investments.

How it works:

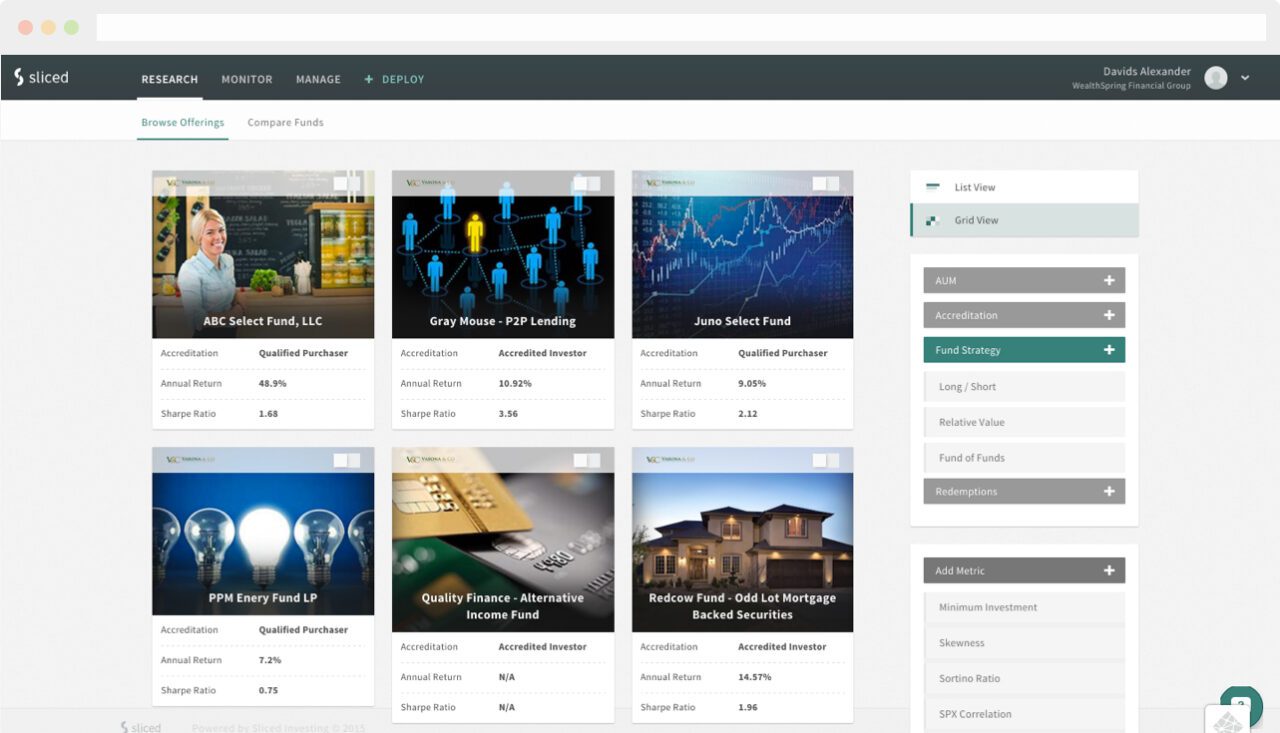

Browse:

Browse and filter alternative investments to find those that suit client preferences.

Image may be NSFW.

Clik here to view.

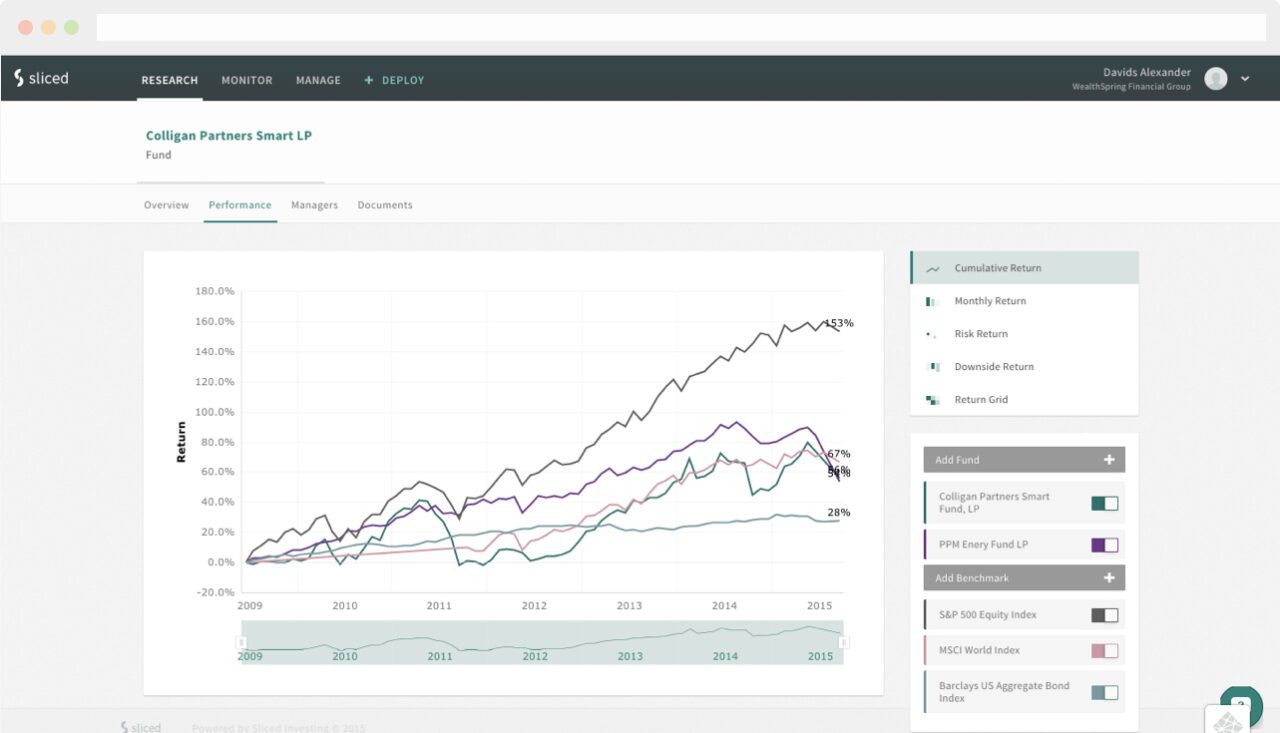

View performance:

Review and compare fund performances. Sliced offers institutional-quality analytics and risk management tools.

Image may be NSFW.

Clik here to view.

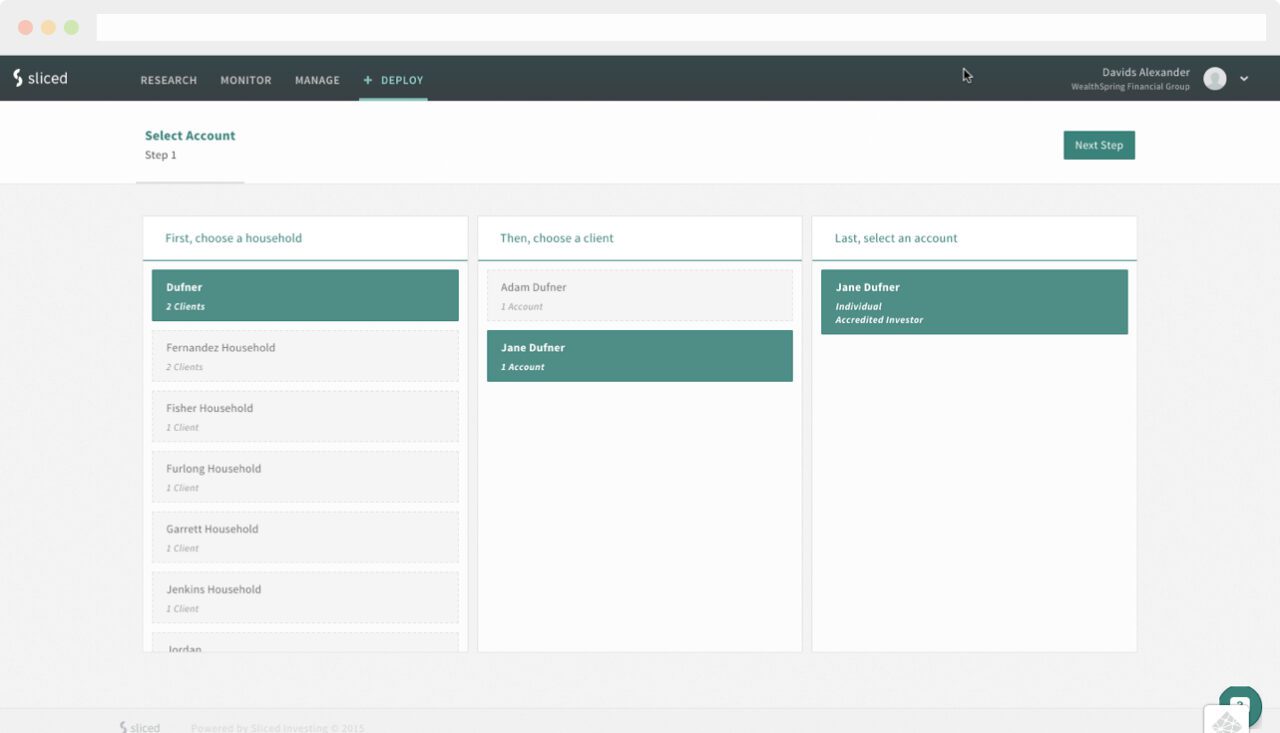

Deploy:

Once an advisor finds a suitable strategy, they deploy it in minutes by sending their client an agreement and digital paperwork directly from within the Sliced platform.

Image may be NSFW.

Clik here to view.

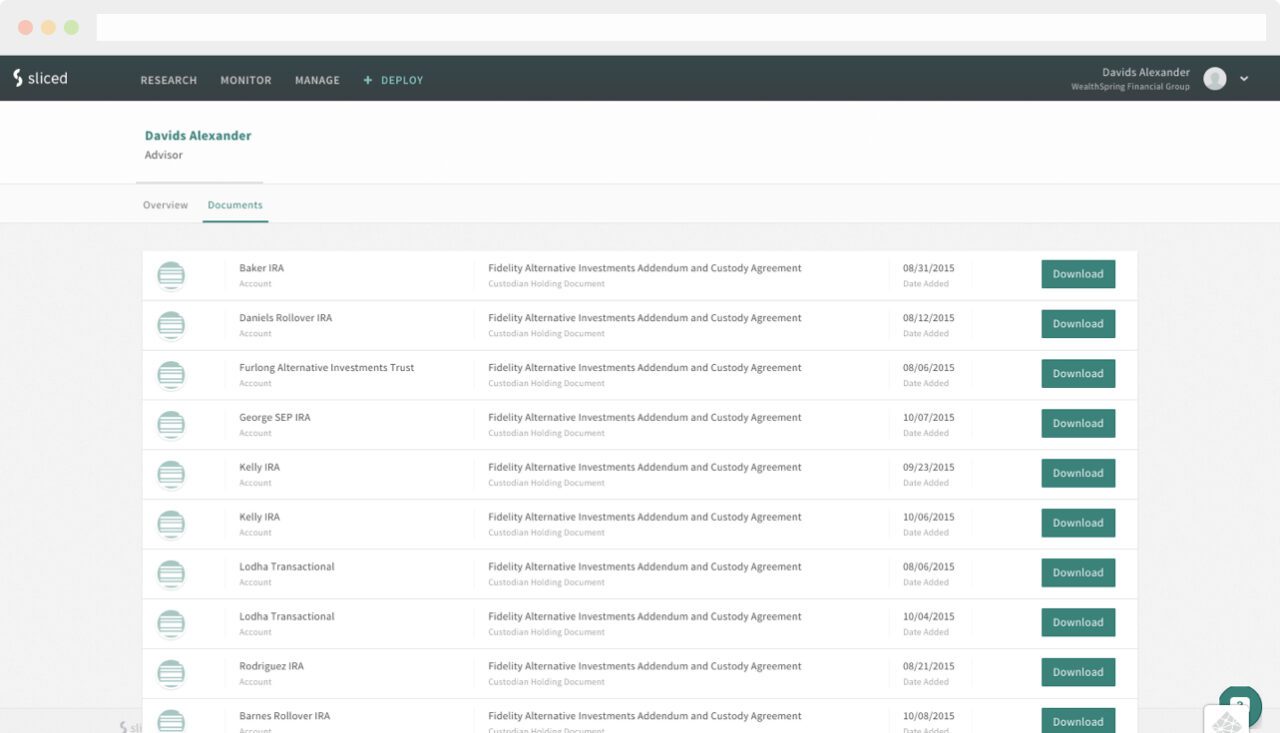

Client overview:

Advisors see an overview of all investment activity and have access to client documents.

Image may be NSFW.

Clik here to view.

The Sliced platform can be white-labeled for family offices, brokers, pension funds and endowments.

What’s next?

Sliced is working on a robo-advisor for alternative investments and a set of algorithms to help advisors compete against robo-advisors. The company is also building tools to offer a single sign on to eliminate password confusion.

Sliced Investing CTO & Co-Founder, Akhil Lodha, and CEO & Co-Founder, Mike Furlong debuting Sliced Institutional at FinovateFall 2015:

The post Finovate Debuts: Sliced Investing Provides Advisors with Access to Alternative Investments appeared first on Finovate.