In a move that expands its SME financing, Lending Club announced it will extend multi-draw lines of credit to small business borrowers.

The new multi-draw option enables borrowers to withdraw only the funds they need, as they need them – instead of extending all funds up front and charging interest on the full sum from the start of the term. Lending Club charges a 1% to 2% fee each time borrowers draw down on the line of credit.

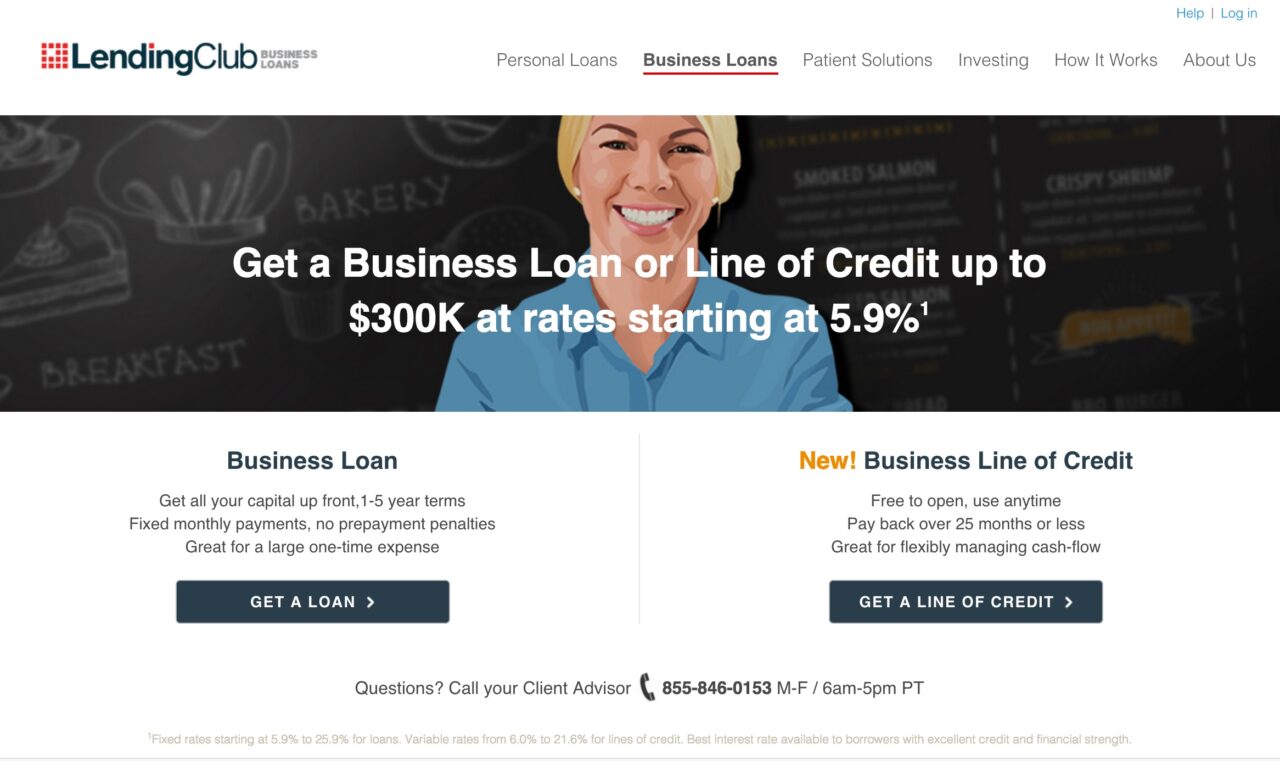

It is free to apply for and open a line of credit, which ranges from $5,000 to $300,000 and charges interest rates starting at 6%, and there is no hard credit inquiry.

Lending Club CEO, Renaud Laplanche states:

“Our platform’s new multi-draw line of credit product gives them a predictable, flexible, low cost way to access credit ‘on demand’ if and when they need it,”

To qualify for the new offering, which has been in beta for the past few months with Alibaba.com and Ingram Micro customers, the borrowing company needs to have been operating for at least two years and have $75,000/ year in revenue.

Lending Club debuted at FinovateFall 2007 in New York. Check out its retro launch demo here.

The post Lending Club Launches SME Multi-Draw Line of Credit appeared first on Finovate.