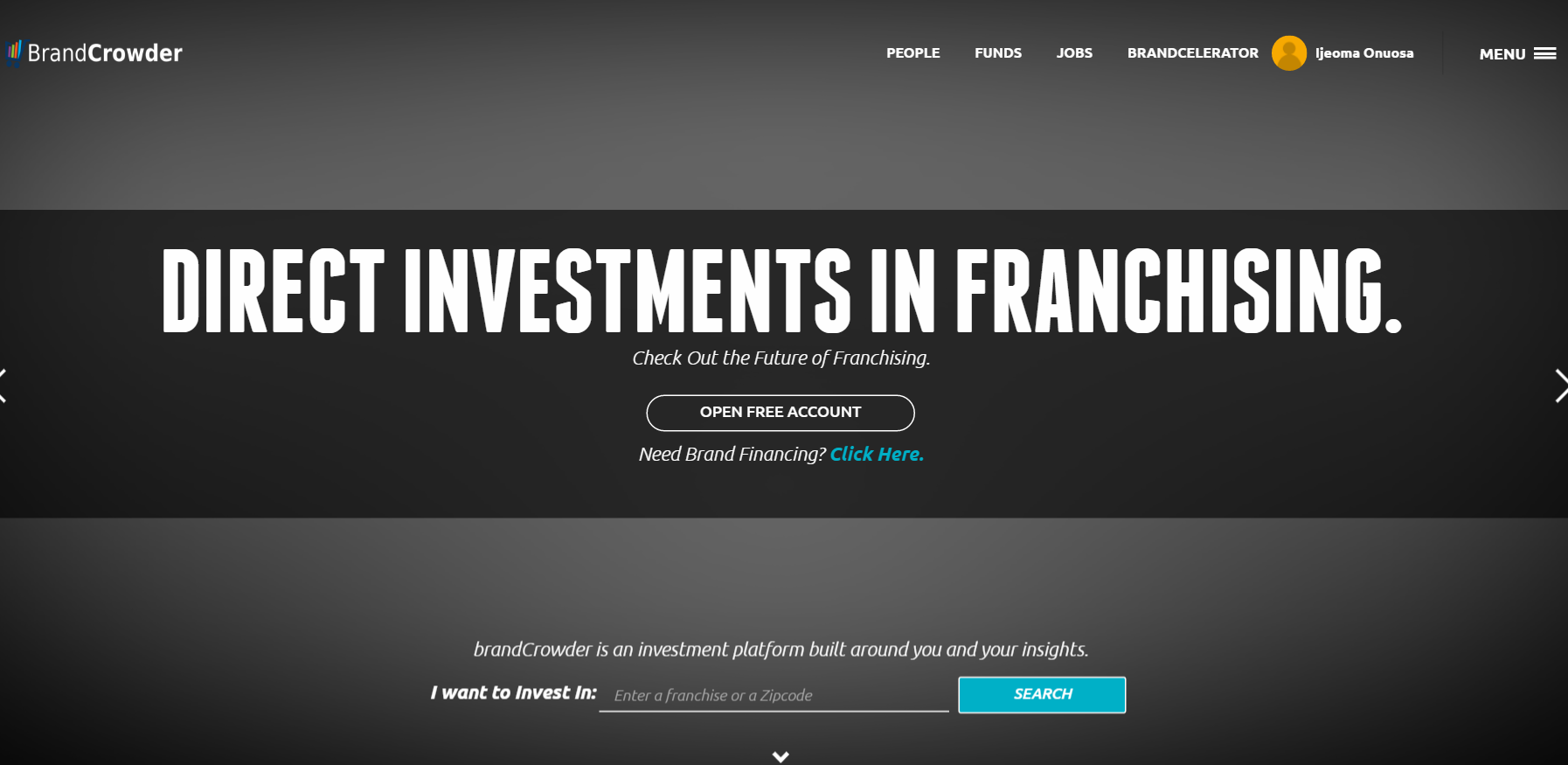

With Brexit and other turmoil driving recent market uncertainty alternative investments are getting an even closer look. The most recent startup to join the alt-investment movement is brandCrowder, a company that facilitates investment in franchises.

In his FinovateSpring 2016 demo Ijeoma Onuosa, the company’s President and Co-founder, said, “brandCrowder, in essence, seeks to lower the barrier of entry into the market and offer to the market our curated deals.” Onuosa went on to detail how franchise-related equities have outperformed the US stock market by 33%.

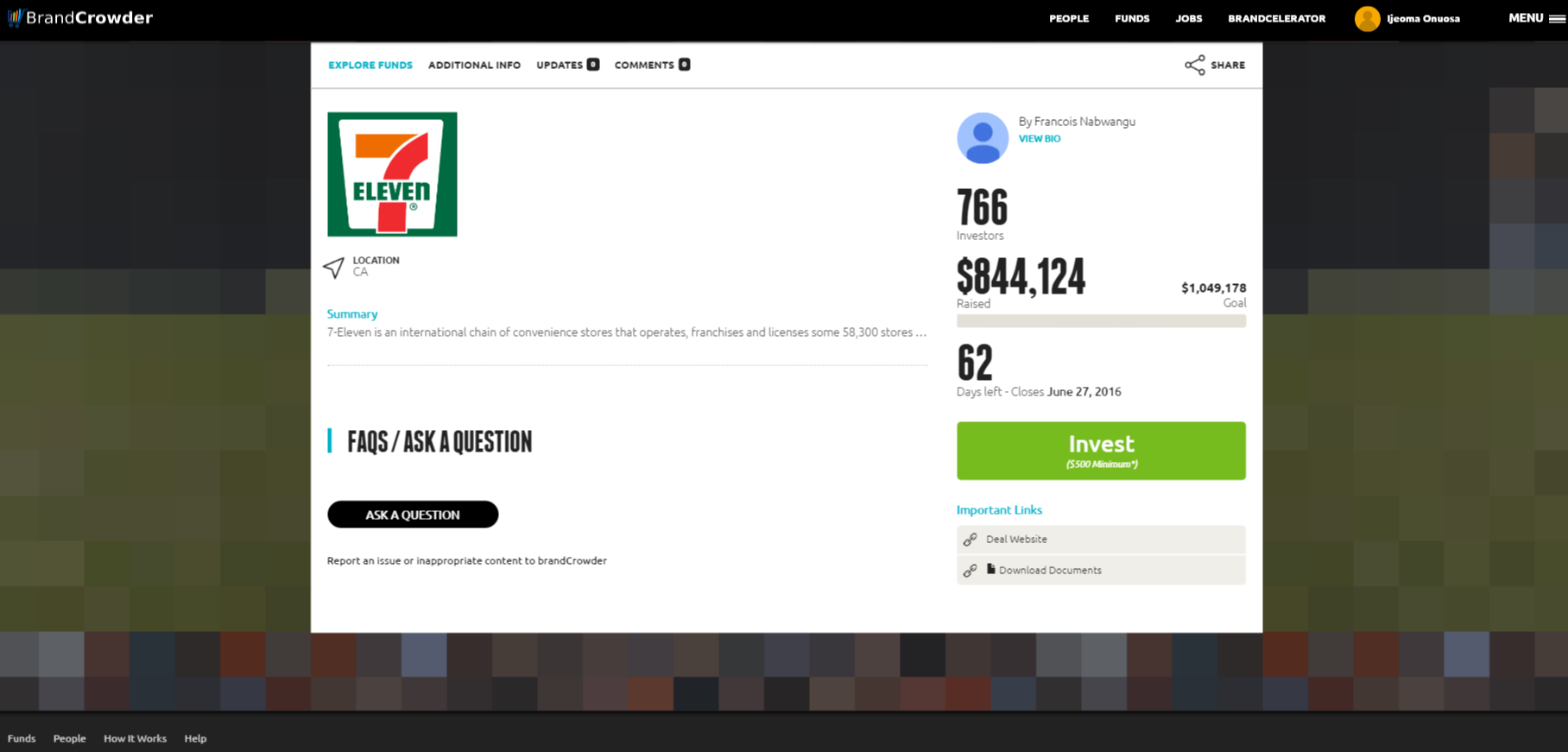

Accredited investors can invest in single company funds, syndicated funds, and portfolio funds while non-accredited investors can participate in national deals that fall under Regulation D of the JOBS Act. brandCrowder’s goal is to let everyone compete on a level playing field that Onuosa describes as a “yield-rich environment.”

Company facts:

- Founded in 2015

- Headquartered in Birmingham, MI

- Offers franchise deals for 3,800 brands in 170 industry sectors

![26593177943_e4eeeb0c89_k]() Francois Nabwangu (CFO) and Ijeoma Onuosa (Co-founder and President) demo brandCrowder at FinovateSpring 2016

Francois Nabwangu (CFO) and Ijeoma Onuosa (Co-founder and President) demo brandCrowder at FinovateSpring 2016

Before brandCrowder stepped onto the FinovateSpring 2016 stage I chatted Robert Armiak, the company’s CEO. Prior to joining brandCrowder, Armiak spent 18 years at Alliance Data where he served as SVP of Finance & Treasurer.

Before brandCrowder stepped onto the FinovateSpring 2016 stage I chatted Robert Armiak, the company’s CEO. Prior to joining brandCrowder, Armiak spent 18 years at Alliance Data where he served as SVP of Finance & Treasurer.

Finovate: What problem does brandCrowder solve?

Armiak: Two Pain Points—One Solution

- Issue #1

Traditional bank underwriting for portfolio holders of operating franchise units is broken (i.e., this $10 trillion market is illiquid, how does “McDonald’s guy” gain liquidity).

- Issue #2

Consumer access to higher yielding alternative asset choices (i.e., if you’re a non-operator investor how do you passively participate in profits much like the stock market).Solution

Equity participation in franchise-generated free cash flow via commonly accepted and widely adopted structured financial products and recently adopted Title II and III regulations and guidelines.

Finovate: Who are your primary customers?

Armiak:

- Franchisor

- Franchisees

- Institutional Investors

- Accredited Investors

- Non-accredited Investors

Finovate: How does brandCrowder solve the problem better?

Armiak: Our executive team is leveraging decades of industry-specific knowledge into an efficiency-focused alternative investing platform that will ultimately increase the velocity of capital in the United States.

Finovate: What in your background gave you the confidence to tackle this challenge?

Armiak: Former Board Member, SVP Finance and Treasurer Alliance Data Systems (NYSE; ADS). Helped form ADS and took the “Big Data” company public in 2001 at a $500mm market cap which has since grown to over $13B. Issued nearly $11B of asset backed securities and another $7B of debt and equity to fund ADS growth.

Finovate: What are some upcoming initiatives from brandCrowder that we can look forward to over the next few months?

Armiak: Beta Launch (August 2016)

Finovate: Where do you see brandCrowder a year or two from now?

Armiak: Actively assisting hundreds of brands, thousands of franchisees and millions of investors reach their near and medium term franchising goals more efficiently.

Finovate What kind of metrics or facts about brandCrowder can we share with readers?

Armiak: We have over $300 million in offerings, from some of America’s favorite brands in our current pipeline ready to come to market.

The post Finovate Debuts: brandCrowder Offers Crowdfunding for Franchises appeared first on Finovate.

Francois Nabwangu (CFO) and Ijeoma Onuosa (Co-founder and President) demo brandCrowder at FinovateSpring 2016

Francois Nabwangu (CFO) and Ijeoma Onuosa (Co-founder and President) demo brandCrowder at FinovateSpring 2016