Never buy another device. Never own a computer again. While these statements sound like a Luddite’s mantra, they are the basis for LiftForward’s new platform.

LiftForward launched in 2013 as a marketplace loan platform where investors lend small businesses up to $1 million. This lending platform is the basis for the company’s TaaSLift, a technology-as-a-service platform that enables LiftForward clients to finance product purchases for their end customers.

Using this model, businesses pay a flat monthly fee and avoid tying up capital and dealing with asset depreciation schedules.

Metrics:

- 10 employees

- Founded 2013

- Headquartered in New York City

- Funding:

- $2.3M Series A August 2014

- $2M debt financing August 2014

- $7M debt financing March 2015

- $250M debt financing July 2015

Microsoft case study

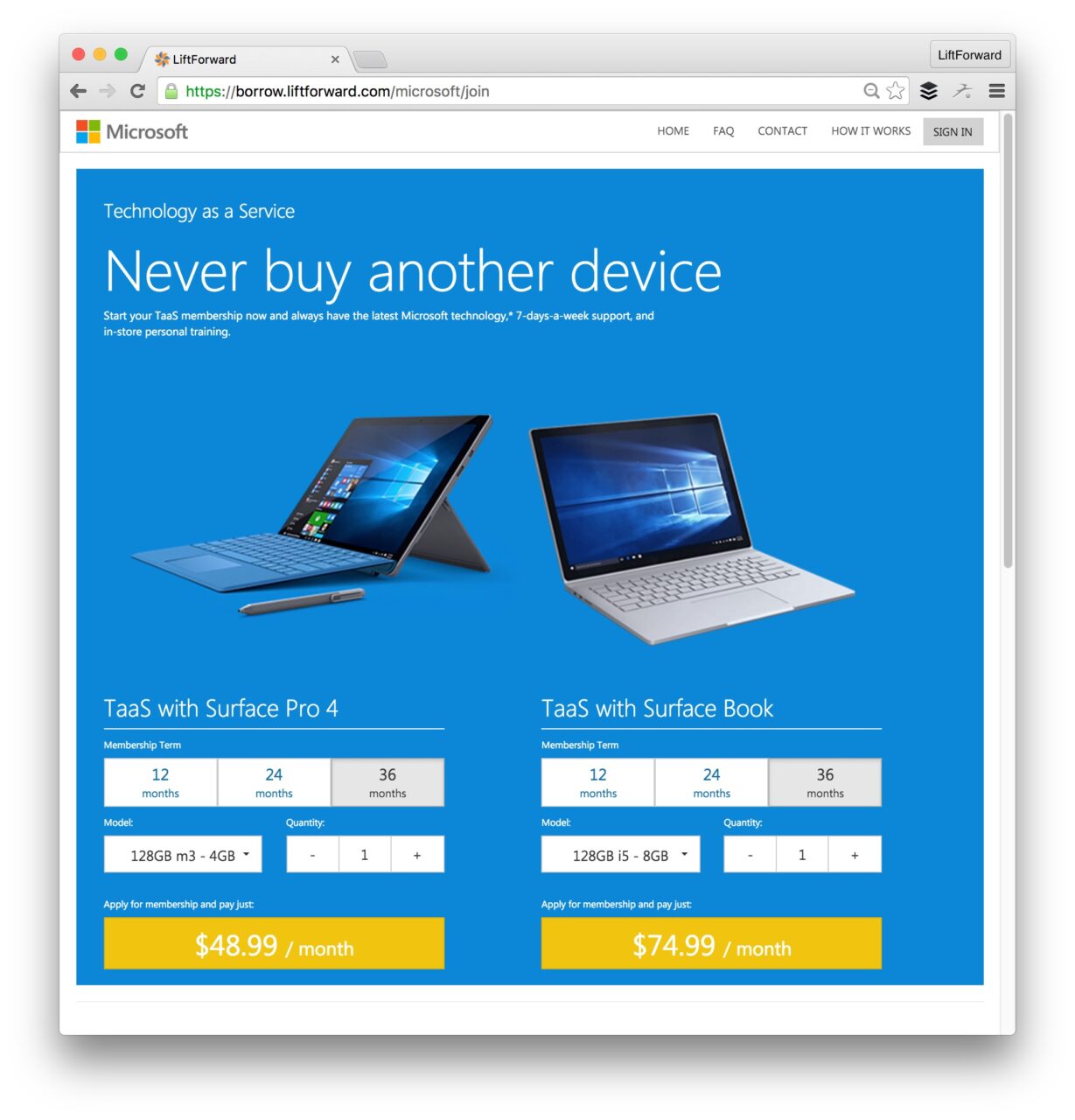

LiftForward’s recent partnership with Microsoft illustrates how business clients use TaaSLift to offer financing. While Microsoft has long been offering subscription versions of Office software, the company was eager to set up a similar model with its hardware; specifically the Surface Pro 4 and Surface Book.

The screenshot below shows how users select their device type, subscription term, and quantity.

At the end of the term, customers return the device, hopefully exchange it for a new one, and begin a fresh term. The key benefit to Microsoft is the technology-as-service increases the lifetime value of the client by making upgrades much easier.

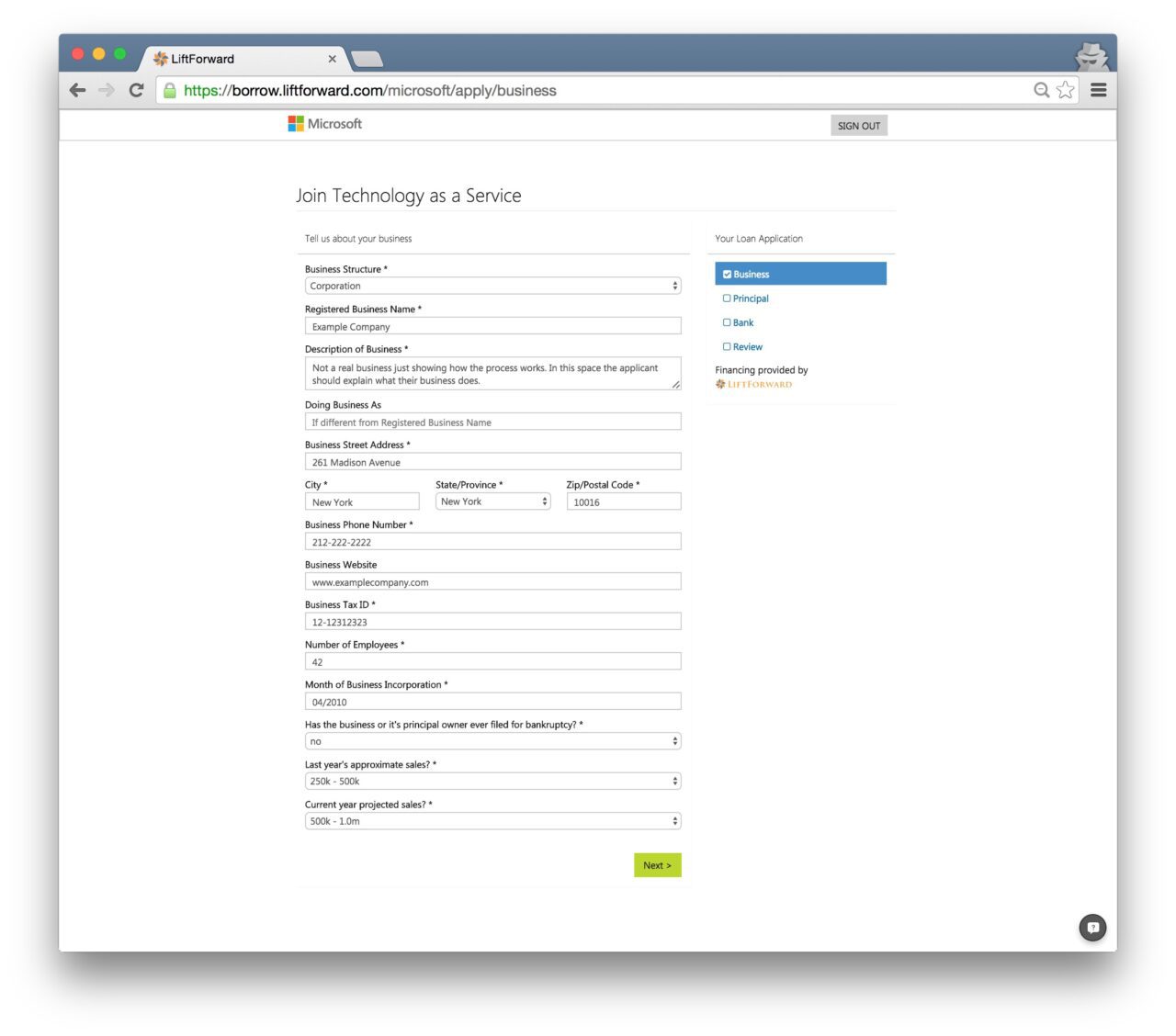

LiftForward handles all the financial aspects. Customers enter their information and financials on a co-branded platform. Once the information is collected, the underwriting process begins.

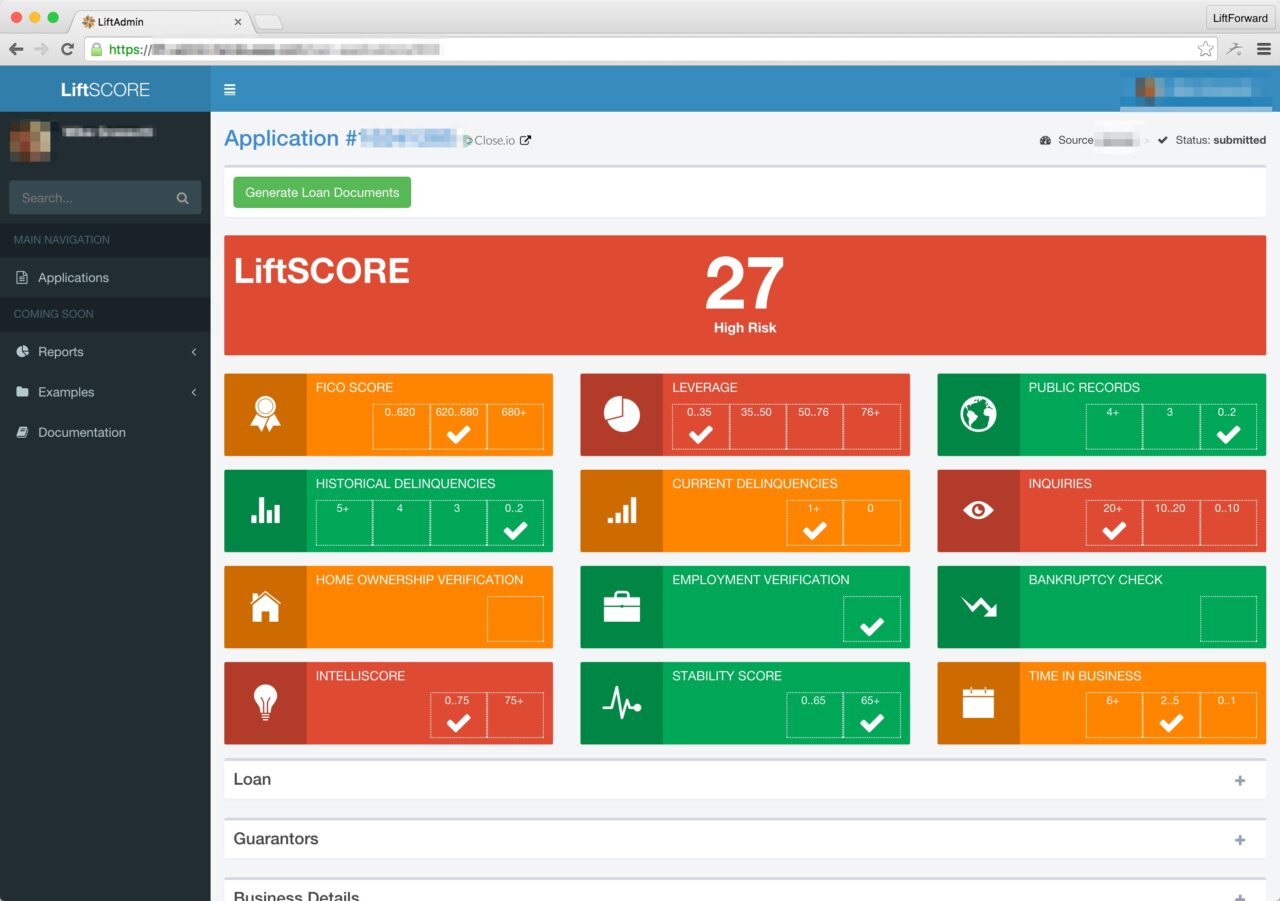

Not only does LiftForward underwrite the loans using its proprietary LiftSCORE, it also funds the loan and bears the risk. The screenshot below shows a high-risk application in the underwriting platform.

After LiftForward approves the request, the customer e-signs online documents, and Microsoft ships the devices along with a membership card, software, warranty, and accessories.

The TaaS platform flexibly scales quantity. It can service a small company in need of two computers or a school that requires two million.

What’s next?

While LiftForward’s current product targets businesses, they are working on a direct-to-consumer offering.

LiftForward CEO, Jeffrey Rogers, and CTO, Michael Grassotti, debuting TaaSLift at FinovateFall 2015:

The post Finovate Debuts: LiftForward Allows Clients to Offer Risk-Free Purchase Financing appeared first on Finovate.